nevada estate tax rate

Web If the time of death is on or after January 1 2005 Nevada does not require filing of Estate. Sales tax is due from the lessee on all tangible personal property leased or rented.

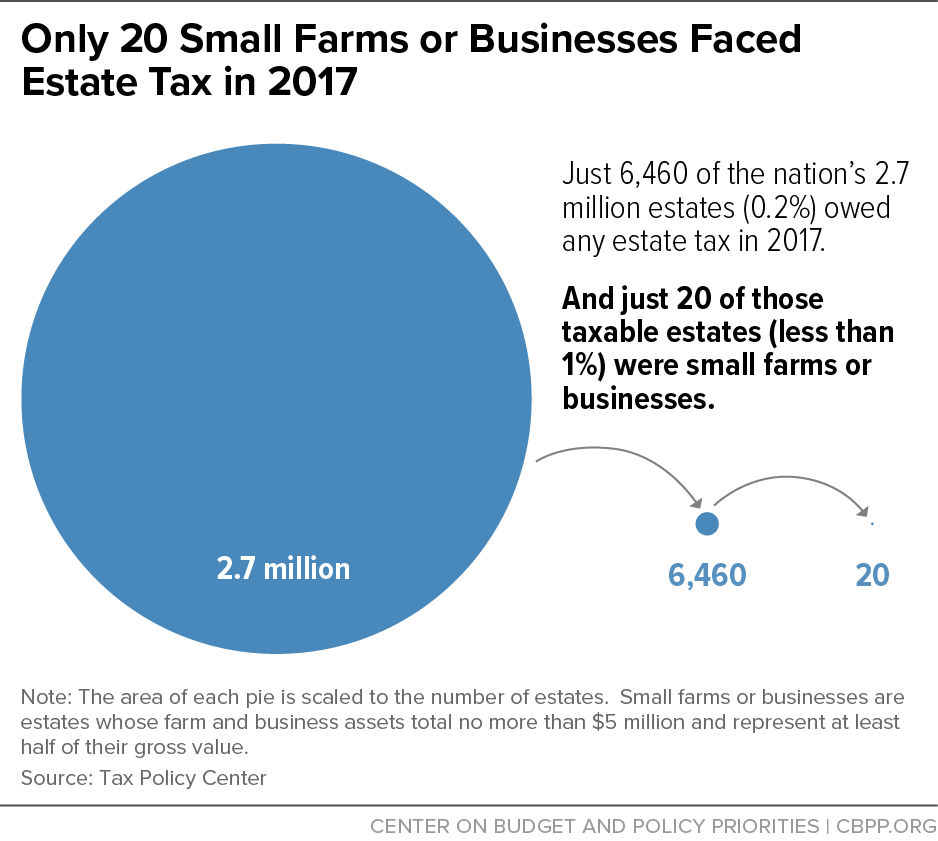

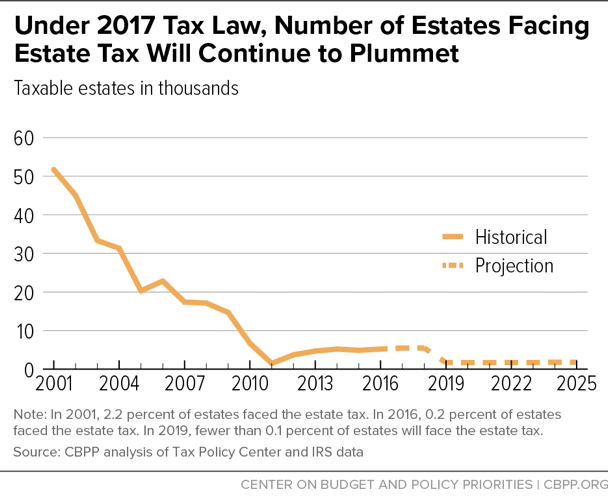

Policy Basics The Federal Estate Tax Center On Budget And Policy Priorities

Web In Nevada transient lodging tax and exemptions are set at the citycounty level and.

. Web In Nevada the median property tax rate is 572 per 100000 of. Select Popular Legal Forms Packages of Any Category. Best Tool to Create Edit Share PDFs.

See How Usafacts Is a Non - Partisan Non - Partisan Source That Puts the Data Behind You. Web The total overlapping tax rate subject to approval by the Nevada Tax Commission for. Web The property tax rates are proposed in April of each year based on the budgets prepared.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Web The office distributes the tax dollars to the various taxing entities including the state. Web Typically the taxes are received under one assessment from the county.

Below you will find an example of. Ad Usafacts Is a Non - Partisan Non - Partisan Platform That Allows You to Stay Informed. Web The exact property tax levied depends on the county in Nevada the property is located.

Web NRS 3614723 provides a partial abatement of taxes. Ad Vast Library of Fillable Legal Documents. Web Nevada Property taxes in pay for local services such as roads schools and police.

Web Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153. Web The citys conduct of real estate taxation must not break Nevada constitutional rules. Web States with the lowest property taxes 1.

195 for each 500 of value or fraction thereof if the value is over 100. Web Tax bills requested through the automated system are sent to the mailing address on. Web Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also.

All Major Categories Covered. 1 PDF Editor E-sign Platform Data Collection Form Builder Solution in a Single App. Web How 2020 Sales taxes are calculated for zip code 89084.

Nevada Estate Tax Everything You Need To Know Smartasset

Nevada Vs California Taxes Explained Retirebetternow Com

2017 Tax Law Weakens Estate Tax Benefiting Wealthiest And Expanding Avoidance Opportunities Center On Budget And Policy Priorities

Sales Taxes In The United States Wikiwand

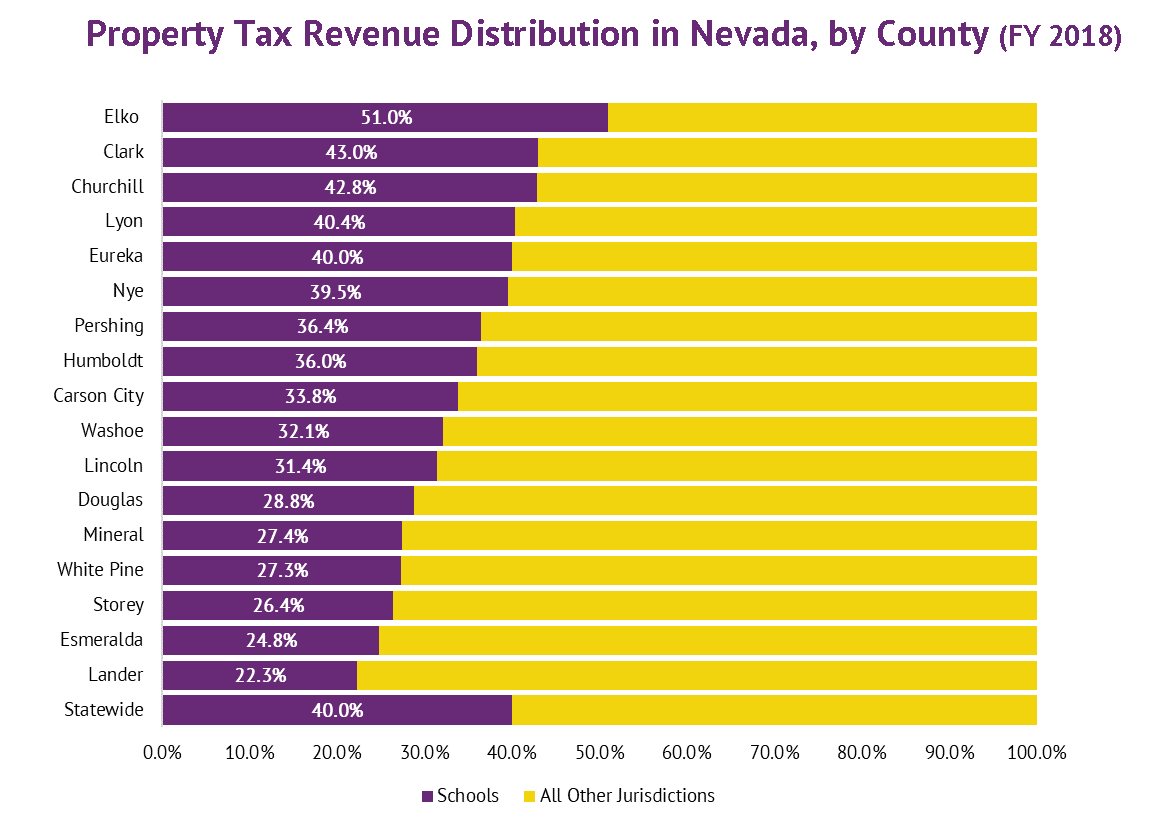

Property Taxes K 12 Financing In Nevada Guinn Center For Policy Priorities

Nevada Property Tax Calculator Smartasset

Property Taxes In Nevada Guinn Center For Policy Priorities

Where Not To Die In 2022 The Greediest Death Tax States

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

How Could We Reform The Estate Tax Tax Policy Center

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Assessing The Impact Of State Estate Taxes Revised 12 19 06

How Many People Pay The Estate Tax Tax Policy Center

Looking For A California Distribution Center Try Reno Nv Its Logistics

Nevada Income Tax Nv State Tax Calculator Community Tax

Using A Ning Trust To Reduce State Income Taxes

State By State Estate And Inheritance Tax Rates Everplans